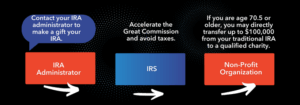

How can I give through my IRA?

If you are 70½ years old or older, you can take advantage of a simple way to benefit a non-profit and receive tax benefits in return. You can give any amount up to $100,000 per year from your IRA directly without having to pay income taxes on the money. This is known as a Qualified Charitable Distribution (QCD) and is commonly called the IRA Charitable Rollover.

What are the benefits of giving through my IRA?

- Avoid taxes on transfers of up to $100,000 from your IRA

- Satisfy your required minimum distribution (RMD) for the year

- Reduce your taxable income, even if you do not itemize deductions

- Make a gift that is not subject to the 60% deduction limits on charitable gifts

- Help further the work and mission of the Kingdom

How does it work?

How do I give through my IRA?

Contact your financial advisor to see if this is a good option for you. If you choose to give from your IRA, ask your advisor to send it to your designated charity.

Would you like more information?

Contact Legacy Giving Coach Tom Aakhus:

614.441.7998

taakhus@coyfc.org